What interviewers truly assess in technology consulting interviews for experienced professionals.

Read MoreWhy HUL Acquired Minimalist

- Aug 21, 2025

- Case study

GoCrackIt Originals: Current Business Problem

Case ID: GCICBP| Beauty & Personal Care (BPC) + Marketing + M&A + Finance | 11 | 21st Feb 2025

Cracking changing consumer behaviour code in Beauty & Personal care: Why HUL acquired Minimalist

©2025 This case is written by Alok Shrivastava, Co-Founders, GoCrackIt & Arpit Gupta, GoCrackIt and as the basis for learning, class discussion & education rather than to illustrate either effective or in effective handling of any entity/ management. This case can not be copied and circulated without the explicit permission of GoCrackIt (www.gocrackit.com).

Introduction

In 2015, if you walked into a beauty store, you’d be bombarded with glossy posters of Bollywood celebrities endorsing luxurious creams, promising flawless skin. Fast forward to today, and the landscape has flipped—scroll through Instagram, and you’ll find Gen Z skincare enthusiasts dissecting ingredient lists, questioning formulations, and demanding transparency.

Imagine this: A 24-year-old urban consumer, scrolling through Instagram, stops at a skincare post—not because of a Bollywood celebrity but because of a science-backed explanation of why “Niacinamide 10%” works for acne scars. No flowery marketing. No exaggerated claims. Just results.

Enter Minimalist—a no-nonsense, science-backed skincare brand that disrupted the industry by putting ingredients before branding. No fancy packaging. No exaggerated claims. Just pure, potent formulations that worked.

So why would a legacy giant like Hindustan Unilever, built on mass-market beauty brands, bet nearly INR 3,000 crore on this challenger? Was it a defensive move, a strategic masterstroke, or the future of beauty retail? Let’s unpack the motivations, market dynamics, and the shifting tides of consumer behavior that made this deal inevitable.

The Rise of Minimalist

Founded in 2020 by Mohit Yadav and Rahul Yadav, Minimalist is a rapidly growing Indian skincare brand known for its science-backed formulations, transparency, and ingredient-first approach.

Minimalists identified a niche of affluent, informed millennials and Gen-Zers— “skintellectuals”—by focusing on transparency and science-backed skincare. Instead of relying on generic “chemical-free” claims that most of the Indian brands did, it educated consumers on active ingredients, earning trust from those who prioritise efficacy over hype. The global trend has also seen more support for transparency in skincare ingredients (NielsenIQ 2024)

Minimalist has built a strong portfolio of best-selling skincare products, some of the most popular one includes:

- Niacinamide 10% Face Serum : For acne marks, acne prone & oily skin

2. All details are from their websites, accessed on 21st Feb 2025

2. Minimalist 2% Salicylic Acid Serum : For oily skin

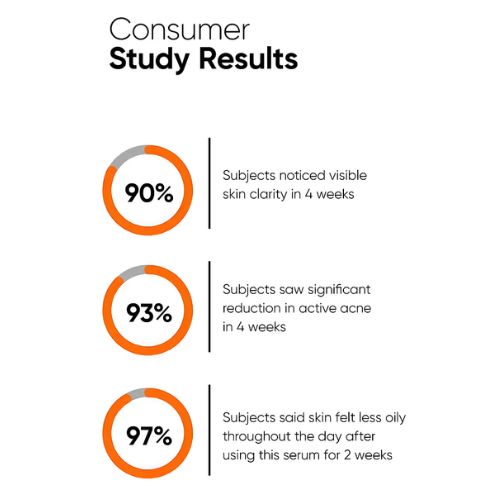

They also publish consumer study of the use of their products, for example as shown in below:

The other products include Minimalist 10% Vitamin C Serum for brighter skin, Minimalist 2% Hyaluronic Acid Serum for skin hydration and Minimalist SPF 50 Sunscreen.

If you compare the Minimalist product with all competitors, the price variation found to be not much at MRP level (although Minimalist seems to be slightly costlier) as shown in Annexure-1.

Financial Performance Source

Minimalist has demonstrated consistent revenue growth and has turned a profit from the beginning, a rare feat in otherwise burn and grow startups landscape.

|

Item |

FY 21 |

FY 22 |

FY 23 |

FY24 |

|

Revenue Growth: |

INR 22 Crores

|

INR 108 Crores 4.9x |

INR 184 Crores 1.7x |

INR 347 Crores 1.9x |

|

Profit Growth: |

INR 5* Crores

|

INR 16 Crores 3.2x |

INR 5.2 Crores -0.3x |

INR 10.9 Crores 2x |

Please note that the decline in profits in FY23 is attributed to the increase in employee expenses brought on by the significant increase in the number of employees.

However, the company recovered with a more than twofold gain in profits while keeping its targeted expense ratio, especially marketing and cogs.

|

Description |

FY 23 (in INR Crores) |

FY 24 (in INR Crores) |

|

Operating Revenue |

184 |

347 |

|

Costs of materials consumed |

71.2 |

101.5 |

|

Advertisement costs |

65.3 |

117.1 |

|

Employee benefit expenses |

18.3 |

28.7 |

|

Profit |

5.2 |

10.9 |

The Acquisition by HUL

Hindustan Unilever Limited (HUL) said it will acquire a 90.5% stake in Minimalist for INR 2,955 crore through secondary buyouts and primary infusion. The remaining 9.5% will be acquired from the founders within 2 years.

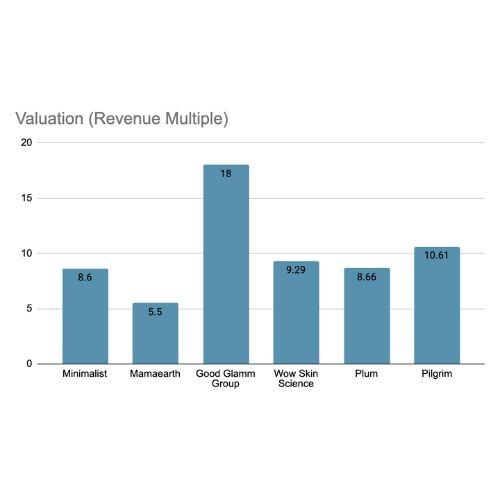

The valuation scene in this space as against the said deal is given in Annexure-2.

Please think through the following questions and answer them.

- Why do you think Minimalist fared so well?

- Why has HUL acquired Minimalist?

- Why is the valuation of Minimalist justified?

Once you are done with your own answers, please find here the sample solution to this case.

Annexure-1 Product benchmarking

|

COMPANIES |

PRODUCTS |

|

|---|---|---|

|

SPF 50 Sunscreen (MRP in INR*, 50g/ 50 l) |

After Discount Price, if any (INR) |

|

|

Minimalist |

399 |

399 |

|

Mamaearth |

349 |

297 |

|

The Good Glamm Group |

360 |

199 |

|

Wow Skin Science |

349 |

349 |

|

Plum |

359 |

323 |

|

Pilgrim |

395 |

395 |

|

Lakme |

339 |

186 |

*The above prices are MRP taken from their respective websites on 20th feb 2025, 02 PM. Some of these firms have given multiple discounts to make it more lucrative for the customers. For example in Mamaearth the discount given is 15%, The Good Glamm Group has mentioned the discount of ~45%,Plum has mentioned the discount of 10%, Lakme has mentioned 45% discount.

Annexure-2 Valuation Scene in Beauty and Personal Care space

|

Company |

Valuation (in INR CR) (year) |

Revenue (year) |

Revenue Multiple |

Remark |

|

Mamaearth |

10500 (2023) |

1920 (2024) |

5.5x |

Their valuation goes through more volatility due to recent financial performance concerns |

|

Good Glamm Group |

10,829 (2024) |

603 (2023) |

~18x |

Facing Financial challenges, with plans to raise Rs.200–250 Cr, sources indicate the post-money valuation could plunge to around INR 1000 Cr |

|

Wow Skin Science |

2,165 (2025) |

233 (2024) |

9.29x |

Valuation declined from $400 million to $250 million, due to consecutive revenue drops |

|

Plum |

2,165 (2022) |

250 (2024) |

8.66x |

rising net losses indicate increased spending, likely on marketing and scaling efforts |

|

Pilgrim |

2,165 Cr (2025) |

204 Cr(2024) |

10.61x |

With its $8.93 million Series B round in August 2024 reinforcing investor confidence |

|

Minimalist |

2,995 (2025) |

347 (2024) |

8.6x |

Valued as per HUL for acquisition |

About GoCrackIt

GoCrackIt is founded by Suhruta Kulkarni, IIMA alumna, Alok Shrivastava, IIMB alumnus and Siddhartha Banerjee, IIMZ alumnus. We are a career mentoring platform. We connect professionals with industry mentors for their career success.

We have had the privilege of collaborating with several renowned B-Schools, including IIM Ahmedabad, Bangalore, Calcutta, Lucknow, Kozhikode, Udaipur, Indore, LBSIM, Goa Institute of Management, ISB, NITIE, BITSOM, SPJIMR, among others, for multiple years.

We have been working with some of these institutes for 4-5 years given the quality of our work.

Our partnership with these institutions has been instrumental in empowering students to navigate their career journeys successfully. We have done around 35000+ hrs of one to one mentoring and thousands of workshops/ group sessions. We have ~ 1000 mentors on our platform.

Website: www.gocrackit.com

LinkedIn : https://www.linkedin.com/company/gocrackit/?viewAsMember=true

Whatsapp: +91-81485-89887

Email : support@gocrackit.com

Get More Insights

Mastering Risk Management: A Guide for MBA Students and Professionals

A practical guide to mastering risk management for MBA students and professionals in business and finance.

Read MoreLeveraging Structured Thinking in Career Transitions

Use structured thinking to navigate career transitions with clarity, confidence, and actionable steps.

Read MoreQUICK LINKS

- Home

- About

- Career Conversations

- Resume Reviews

- Mock Interviews

POLICIES

- Terms & Conditions

- Privacy Policy

- Refund Policy

CONTACT

- +91-81485-89887

- support@gocrackit.com

- #518, Ground Floor, 10th Cross, Mico Layout, BTM 2nd Stage, Bangalore - 560076